The Crypto Convergence

3 Bullish Signals Will Flash Green in the Next Few Weeks

Each of these events is enough to move the crypto market by itself. But now, all

three are converging at the same time. Last time something like this happened

investors who got in ahead saw returns like 54, 102, even 234 times their money.

Good day, my name is Chris Hurt.

I’ll be your host for today’s urgent crypto bulletin.

You see, there is a phenomenon happening right now that’s never been seen before in the crypto market.

Not just one – but three extremely bullish signals are going off …

At almost the exact same time.

We predict that this convergence of events is going to have a massive effect on crypto prices.

Far beyond the gains we’ve seen over the last couple of months.

Because as we’ll show you over the next few moments…

Each of these bullish events on its own is enough to drive Bitcoin and other cryptos to new highs.

But when all three come together at the same time, as they are expected to over the next few weeks.

It could mean a crypto bull market of unprecedented proportions.

Even bigger than previous bull markets where select coins brought back returns like:

- 2,001%

- 5,400%

- 10,200%

- 23,400%

Our special guest today, Juan Villaverde, says the recent run up in the price of Bitcoin, Ethereum and a handful of other coins is just a preview of what’s to come.

He believes once-in-a-lifetime crypto gains are in front us …

And it’s because of this great convergence of bullish events happening all at the same time.

In the next few weeks …

Maybe even sooner.

Juan believes this will be the beginning of a nearly two-year bull market that could send Bitcoin to new highs, perhaps reaching $140,000 or more …

And if history is any indicator, smaller altcoins could soar 10,200%, 23,400% ...

One special coin even went up 531,785% in similar circumstances to the current market.

Just $1,000 into that coin would’ve returned over $5 million.

This is the kind of bull market we could be in for, according to Juan Villaverde.

For those who don’t know Juan, he is a world-renowned mathematician with a focus on markets and cycles.

To our knowledge here at Weiss, Juan is the first person to create a timing model used to trade cryptos.

In fact, Juan released this timing model to the public in early 2018 … at the height of crypto mania.

And he called both the top and the bottom for Bitcoin – accurate to within a few days.

If you had bought on the day Juan predicted the bottom …

You’d have made 20.1 times your money on Bitcoin …

Enough to turn a $10,000 investment into $200,832.

Ethereum, the silver to Bitcoin’s gold, went even higher, increasing 54 times over.

Enough to turn a $10,000 investment into $545,760.

A few other coins did even better.

Cardano surged 102x … turning $10,000 into $1,020,648.

Chainlink topped them all. It rose 234 times, which could have grown an initial $10,000 investment into an asset worth $2,338,746.

Today, Juan is going to reveal the inner workings of his crypto timing model.

Particularly what it has to say about 2024.

But he’s also going to show you why this bull market could be the greatest in crypto history.

Because three major market-moving events are expected to happen within weeks – perhaps even days – of each other.

If they do, Juan predicts the crypto bull market will launch into overdrive …

Today, Juan will explain what these three key crypto events are …

Why he expects them to happen in the first quarter of 2024 …

And why there are a few specific coins that he believes will benefit the most …

Juan will share the details about these coins. And he’ll show you the best way to invest – before these signals flash green.

These three signals will be the impetus for the surge ahead …

A convergence with no precedent in crypto history.

But don’t just take my word for it.

Let’s bring in the expert, Juan Villaverde, to help us break it down.

CHRIS: Hello Juan, great to see you again.

JUAN: Hi Chris, it’s always nice to join you.

CHRIS: Juan, I was just briefing the folks at home about the situation at hand.

What you’re calling The Crypto Convergence

Can you explain to us what that means?

JUAN: We’re on the verge of three extremely bullish crypto events, Chris.

Each of these events is powerful enough to launch a bull market on its own.

But, through sheer luck and circumstance …

All three of these events are expected to happen at the same time …

Making this perhaps the best time to buy crypto in history.

But things are moving so quickly, these signals could happen even sooner.

In fact, I’ve got some breaking news to share right now, Chris.

Our first signal has already happened.

That’s how quickly events are moving. And how fast these cryptocurrencies are rising.

CHRIS: So, what is the first signal, or event, as you call it?

JUAN: It’s both an event and a signal.

This is a specific event that just happened days ago.

This will be the spark that leads to a roaring prairie fire when it comes to market participation.

The SEC has approved a Bitcoin ETF run by $9 trillion Wall Street behemoth BlackRock.

And I expect dozens of others, from reputable Wall Street firms like Fidelity, Invesco, WisdomTree, Ark Investments and Valkyrie could all be approved in the next few days as well.

CHRIS: What would these ETF approvals mean for the crypto market, Juan?

JUAN: It’s very simple, Chris. Once these ETFs go live, a lot more people will be able to invest in crypto.

Right now, you have to be an enthusiast. There are a number of steps, either mining it yourself, or opening a wallet and then figuring out which sources to buy from.

When approval happens, you’ll literally just click a button and buy an ETF that tracks the price of Bitcoin – but does all the rest for you.

A whole new set of market participants will jump in because it’s easy …

And it will be backed by a massive Wall Street bank, so there is at least the illusion of safety.

Estimates are that over $3 billion worth of investment money would pour into one of these Bitcoin ETFs in the first few days of trading alone.

CHRIS: And obviously, that would have a massive impact on prices.

JUAN: That’s right.

That’s why I say, just this one bullish event alone could be enough to move Bitcoin prices.

The Wall Street Journal said BlackRock ETF approval will have an “electric effect” on the crypto market.

Standard Chartered believes ETF approval will be enough to push Bitcoin to $100,000 by the end of 2024.

That’s nearly double its current price.

But I tell you what, Chris …

I think it will hit $100,000 a lot sooner than that.

Because while BlackRock’s ETF approval is a majorly bullish event …

It’s only the first of three different events that make up The Crypto Convergence.

The next two will happen in the coming days.

CHRIS: So, what’s the next signal, Juan?

JUAN: It’s a very rare occurrence in the crypto world.

But it has a massive impact on prices.

This is only the fourth event of its kind.

Every time, the price of Bitcoin – and other coins has spiked.

I’m talking about the Bitcoin halving.

CHRIS: I’ve heard about that, but I’m not quite sure exactly what it means.

JUAN: I don’t want to bore you or our viewers with a bunch of technical details.

But in short, Bitcoin is handed out to miners in so-called “blocks.”

In the early days of crypto, these blocks were valued at 50 Bitcoin.

The creators of Bitcoin created a mechanism to devalue these blocks after a certain period of time.

So, for every 210,000 blocks mined – the price of the blocks would be cut in half.

As expected, we reached another halving in April.

CHRIS: How many halvings have there already been?

JUAN: In the history of Bitcoin, there have been three halvings.

The one in April was the fourth.

And they’re expected to continue until roughly 2140, when it’s predicted all of the Bitcoin will be mined.

CHRIS: So, how do these halvings affect the price of Bitcoin, Juan?

It seems like it’s designed to drive the price up.

JUAN: That’s how it’s worked out in every other halving, Chris.

The first Bitcoin Halving happened on Nov. 28, 2012.

In less than a year, Bitcoin’s price went from $12 to $1,032.

An 8,500% increase …

CHRIS: Just putting $10,000 into Bitcoin before the first halving would’ve brought back $850,000.

JUAN: The second Bitcoin halving came on July 9, 2016.

Over the next year and a half, the price rose from $651 to $20,089.

That’s a 2,985% gain.

CHRIS: Just $10,000 invested in Bitcoin before that halving becomes nearly $300,000.

JUAN: It happened again in 2020.

On May 11, 2020 – in the middle of the Covid crisis – the third Bitcoin halving took place.

And just like the first two, the price rocketed up soon after.

Over the next 18 months, Bitcoin surged from $8,787 to an all-time high of around $66,000.

That’s a 651% return.

CHRIS: So, the Bitcoin halving has been enough to drive up the price of Bitcoin by itself.

The lowest gain was 6 times your money.

And now a halving has happened again.

Just weeks after the approval of the first Bitcoin ETF ever.

How high could the price of Bitcoin go?

JUAN: Obviously it’s hard to speculate.

But my estimates are that Bitcoin could reach $140,000 or more. Four or five times higher than recent lows.

And that’s great, I wouldn’t sniff at a 4-bagger.

But that’s not where the real money is made during the Bitcoin halving.

It’s the smaller altcoins where you have a shot to make really huge fortunes in crypto.

And I don’t want to make baseless predictions that put unrealistic goals in our viewers’ heads.

But let me just show you the effect the most recent Bitcoin halving had on smaller, alternative coins.

CHRIS: If you don’t mind me interrupting here for a second Juan …

Why would these other coins see price increases just because Bitcoin had a halving?

How are they related?

JUAN: Because Bitcoin is the anchor for the whole market.

And when more money starts flowing into Bitcoin, for whatever reason, whether it’s an ETF approval or a halving event …

Then more money also flows into other coins.

Naturally, some investors are going to be looking for a bigger gain.

As you saw, Bitcoin’s returns – while still impressive – have gone down with every halving.

Which makes sense as the coin becomes more mature and more liquid.

As a result, not every investment dollar is going to pour into Bitcoin. More adventurous speculative investors will look for solid coins with high potential.

And those investments have paid off big in every halving.

Because in every halving, there’s been a different set of coins that comes from zero and skyrockets.

While Bitcoin’s gains may get smaller with each halving …

There’s no ceiling on what a newer, exciting crypto project can do in the wake of a post-halving bull market.

For example, just a year after the 2020 Bitcoin halving, a number of alternative crypto projects went through the roof.

Ethereum jumped 1,800% in the wake of the Bitcoin halving.

Another well-known name, like Cardano, went up 2,986% in the next 12 months.

Binance went up 4,222% ...

CHRIS: Every single one of these winners could’ve returned a lot of money for investors.

It’s amazing, it’s almost too easy …

Wait for a Bitcoin halving.

And then invest.

JUAN: And I’ve only shared the gains from a few more well-known, well-traded coins.

A few others literally brought back lottery ticket type of returns.

THORChain seemed to be going nowhere before the 2020 halving, sitting at just 11 cents.

Less than a year later, it was up 20,027%.

Enough to turn a small $5,000 investment into over a million dollars.

Solana was virtually unheard of at the time of the last halving – sitting at just 63 cents.

But 18 months later, it was up 41,198%.

Just $1,500 invested would’ve brought back over half a million dollars.

Of course, these are the most extreme examples of gains. Past performance doesn’t guarantee future results.

But this is the kind of thing that can happen in the wake of a Bitcoin halving.

CHRIS: So, we should be looking to buy altcoins?

JUAN: Perhaps a few of them.

But you should be very careful – and selective.

I don’t recommend every single altcoin.

There are lot of phonies and scams out there.

In fact, I think there’s only a small handful worth your money.

These are the coins that I think will really explode as these events play out.

CHRIS: And you’re going to share the details on those coins with us in a moment, right, Juan?

JUAN: That’s right.

I’m going to give everyone watching this video a chance to learn what coins are the best way to play this coming bull market.

In every crypto bull market, there are new coins that come out of the woodwork and become a part of the crypto establishment.

If you can identify them ahead of time … or early in the run up – you could make a fortune on these new superstars of the space.

I’ve developed a system for doing that.

And the results have been excellent.

Overall, since inception, the average gain of my tried-and-true systems is 201% ... and that includes the losers.

CHRIS: I can’t wait to hear which cryptos you recommend Juan.

But I want to clarify something first.

You said at the outset, there are three major events coming for crypto.

We just got Bitcoin ETF approval …

Then there’s the Bitcoin halving, which happened in April.

Both of these events are enough to drive up the price of cryptos on their own.

But you said there’s a third event that will combine with these other two to create a perfect storm type situation.

What you’re calling The Crypto Convergence.

This Crypto Convergence could lead to the most exciting bull market in the history of cryptos happening this year, in 2024.

So, what is this third event, Juan?

What will be the final spark for this bull market?

JUAN: It has to do with my proprietary crypto timing model.

CHRIS: The one that predicted both the top and the bottom in 2018 – within a matter of days?

I’m sure there’s folks out there who must think this is a fluke, or a lucky guess or something like that …

Do these bottoms and tops happen all the time? Or was that just a one-off?

JUAN: I’m glad you asked that Chris.

It’s probably the thing I’m asked the most by followers on Twitter, or at crypto conferences.

The truth is, there is indeed a pattern to how crypto trades.

And with the help of some powerful computing, data analysis and my own background as a mathematician …

We were able to identify those patterns.

CHRIS: As far as I know, you’re the first in the world to do it, correct, Juan?

JUAN: That’s correct.

Or at least, I was the first to talk about it publicly.

When it came to calling the top in 2018, it sure didn’t win me any friends.

CHRIS: Of course. Those were the days of the Hodl memes when cab drivers and housewives were getting rich on Bitcoin.

You were the guy telling everyone the party was over.

It probably didn’t go over well.

JUAN: It didn’t.

But I felt confident because to your point, I knew I wasn’t guessing.

The history of Bitcoin and crypto had shown a clear trading pattern.

And in early 2018, the market was due for a correction.

It showed up right on time, just as our timing model said it would.

CHRIS: Now, before that bull market in 2017 and early 2018, very few people had even heard of crypto.

Even less were trading it.

So how were you able to identify a pattern in an asset that was so new?

JUAN: I’ve studied market timing for years, usually related to the stock market.

But I was also one of the first people to regularly trade crypto.

Supposedly this market was random … or so I was told.

But market cycles are real …

And when I applied my math to the crypto market, I found the same thing I found in every other market, from stocks to bonds to real estate and more.

There is a distinct pattern to the way cryptocurrencies move …

It typically happens over four years, like clockwork, every time.

I use Bitcoin as an example, but this is true for all cryptos.

But Bitcoin has had four bull-market cycles in its history.

You mentioned my big call in 2018, Chris?

Let me show you how easy it was to make that call …

If you had my crypto timing model.

Using my math and trading background, I created a proprietary algorithm that tracks the true movement of Bitcoin and other crypto.

And when I analyzed the results I saw that crypto, especially a mature coin like Bitcoin, trades in a very orderly pattern.

I discovered there are four distinct phases to any Bitcoin bull market. And each phase lasts about a year.

Take a look at Bitcoin’s chart from 2014-2017.

The first stage is called the Big Bear.

It usually comes just after a recent peak.

It lasts about a year and drives the price down.

The second stage is the Transition stage – investment is starting to pick up after a breather.

No new lows are made, hence the transition from bear to bull.

But at this stage, we still don’t see the truly big move yet …

Stage three is the Big Bull – a spike that appears to reach a top.

Only for Bitcoin to stride into Stage Four – the Bigger Bull – which moves the price even higher.

And then the cycle starts again.

It happened from 2014-17.

CHRIS: But this wasn’t the first time it happened right?

You mentioned you already knew the cycle was due to reset in 2018 …

Was there a crypto bull market cycle before the one that started in 2014?

JUAN: Yes, there was .

Since Bitcoin began trading actively, it has enjoyed four bull-market cycles.

And each has followed a similar pattern.

Bitcoin first began trading on July 16, 2010.

Anyone who bought at this early stage and held through the end of this first, atypically short bull market cycle could’ve made 606 times their money on this opening volley.

Fast forward to Nov. 11, 2011, when Bitcoin made its first big bottom.

If investors had bought Bitcoin here and held it for the duration of the second cycle, they could have made 539 times their money.

CHRIS: So those were the first two bull market cycles.

2014-2017 was the second big cycle.

Bitcoin investors could’ve made 59 times their money during that bull market.

But that’s also when a number of altcoins hit the scene, am I right?

JUAN: Yes, in every bull market, there are smaller coins that make far more than Bitcoin.

Litecoin jumped 7,850%.

Nearly one and a half times better than Bitcoin …

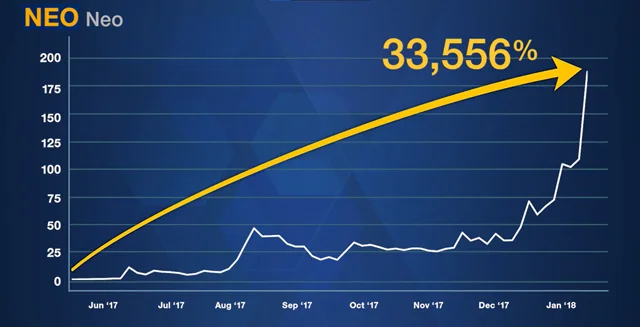

NEO brought back 33,556% ...

Six times more than Bitcoin …

NEM returned 50,425% in 2017 alone …

Nine times more than Bitcoin …

Bitcoin goes up less and less every time.

But there’s always a new coin starting at zero.

CHRIS: Eventually you called the top of that market in early 2018.

And then you called the start of the third bull market cycle in late 2018.

It’s worth revisiting how high Bitcoin, Ethereum and a number of these smaller, so-called “altcoins” jumped after your bullish prediction.

JUAN:, If you had bought Bitcoin on the day I called the bottom you’d have made 20 times your money on this third bull market cycle.

And 54 times your money on Ethereum.

But again, smaller coins would’ve brought back the best rewards.

Cardano went up 10,200%.

And ChainLink soared 23,400%.

Now, some of these coins are household names. But at the start of the bull market, very few investors knew about them.

CHRIS: One thing I noticed there Juan, in the three bull markets, Bitcoin and Ethereum’s gains have gotten smaller each time.

They’re still very impressive, but with each bull market, less so.

JUAN: That’s right, Chris.

It makes sense because with each new bullish cycle, the crypto market – and steady coins like Bitcoin and Ethereum – become more mature.

There’s more liquidity … More market participation … and less unpredictable swings.

So, there’s a bit less money to be made every time.

For instance, I expect Bitcoin to hit $140,000 in this coming bull market.

And that would be a big deal optically, for the confidence of Bitcoin investors.

But that would only be around four times higher than the most recent bottom.

A fraction of the gains Bitcoin has made in previous bull markets.

Still impressive, but not life changing.

CHRIS: Are life-changing gains still available in the crypto market, Juan?

JUAN: Oh yes …

But you have to know the right coins to buy and the right time to buy them.

Luckily, our crypto timing model applies to all coins – not just Bitcoin or Ethereum.

In every bull market, there’s a new set of alternative coins who are thrust into the spotlight.

And if you know when the bull market is coming, you can start hunting for these diamonds in the rough.

This is how investors have made 102x, 234x or more in previous bull markets.

I’ll share my secret weapon when it comes to identifying promising altcoins in a moment.

When you combine this secret weapon with my timing model, it’s a recipe for success.

You have the potential to maximize the bull markets and minimize the down times.

CHRIS: Before we get to that, I think it’s important we show our viewers exactly where we stand on your crypto timing model at the moment.

Why are you so confident a bull market is on the way?

JUAN: Let me make a clear distinction here for a moment, Chris.

A bull market isn’t just on the way.

It’s here, right now.

It’s already begun.

2022 was where we hit the big bear market. A bottom formed and we went through a transition year in 2023.

Now, Bitcoin – and every other worthwhile coin out there – are moving upward and into what my research tells me will be a Big Bull year in 2024.

That should then be followed by a Bigger Bull year in 2025.

I hope you can see that now is the time …

We’re not waiting for a bull market to invest.

The bull market is here. Everything is telling me the time to get in is now.

With the addition of a Bitcoin ETF approval – and the Bitcoin halving …

I believe this is a once in a lifetime opportunity for a nearly sure thing bull market.

Bitcoin is going up …

Ethereum is going up …

And a number of altcoins are going to all-time highs.

CHRIS: So, this is the third signal.

JUAN: That’s right.

My timing model has shifted into bull market mode.

This is the third bullish event for crypto all happening within the same few weeks.

But I can’t stress enough, this third event is already happening. We’re well into a new Big Bull year. Year 3 of the four-year bull market cycle.

Bitcoin ETF approval and the Bitcoin halving have already happened.

CHRIS: So how should we invest in this bull market, Juan? What’s the best way to go about it?

JUAN: First off, you should only devote a small percentage of your overall portfolio to crypto.

I believe in the future of cryptocurrencies. But so much of it is still speculation.

You should view it that way and only allocate an amount you’re comfortable with.

CHRIS: Noted. I think that’s great advice. Investors never want to get carried away over any one investment.

JUAN: With that being said, I think you need to split your crypto money two ways:

You need to park some money in Bitcoin – and its partner Ethereum.

In every crypto market, Ethereum tracks Bitcoin’s gains – but even higher.

In the last bull market, Ethereum made nearly 10 times more than Bitcoin.

It’s like the silver to Bitcoin’s gold.

These are the two oldest and most stable coins on the market.

And while the gains aren’t nearly as high as they can be for some altcoins, they do tend to be steadier …

CHRIS: In other words, these two coins are the safer crypto investments.

JUAN: That’s right, Chris.

If there’s going to be a bull market in cryptos, it’s going to include Bitcoin and Ethereum.

So, you’ll get the benefits of the bull market …

With the safety of knowing you’re parking your money in two of the most stable coins out there.

But the big money is still in the altcoins.

This is where investors have made the truly life-changing gains.

Like the 234 times your money investors could’ve made on ChainLink.

That’s enough to turn a modest $5,000 investment into $1,170,000.

You could retire on that money.

Will you be able to do that in this bull market?

Past performance doesn’t guarantee future results, so please keep that in mind.

But I have a secret weapon up my sleeve.

CHRIS: A secret weapon?

JUAN: Yes, Chris.

A tool I use to help me identify the very best altcoins to play for the biggest gains.

Identifying these altcoins can be like trying to find a needle in a haystack.

So, I used my mathematical skills to team up with our analysts at Weiss Ratings.

And we created the first-ever, completely independent, data-driven, ratings system for over 1,000 cryptos.

The Weiss Crypto Ratings have turned out to be a phenomenal tool for predicting which cryptos have promise – and which should be avoided.

In fact, we’ve issued 131 Buy ratings since we invented the ratings system in 2017.

The average gain was 342%.

And that includes the losers.

CHRIS: So, the average “Buy”-rated crypto could’ve brought readers back 3.5 times their money.

I’m sure some of them must of have been big winners, Juan.

JUAN: Dozens of these “Buy”-rated cryptos could’ve made investors life-changing gains.

Viacoin jumped from three cents to $1.79 in just over a year after we rated it a “Buy.”

That’s a 5,508% gain.

After we reissued a “Buy” rating in 2017, Bitcoin jumped 4,464%.

And Ethereum gained 4,404%.

Neo is up 4,166% since we rated a “Buy.”

And Ripple is up 3,989%.

CHRIS: So, what do the Weiss Crypto Ratings say right now, Juan?

Which altcoins should we buy?

JUAN: I can tell you in this interview that Bitcoin is currently rated “A+,” our highest possible rating.

And Ethereum isn’t far behind, at “B,” though it always tends to trail Bitcoin in the early days of bull markets.

CHRIS: And what about some of the alternative coins out there?

Are there any that stand out to you above the others?

JUAN: There is ONE specific altcoin that I love right now.

CHRIS: What makes an altcoin worth loving, Juan?

JUAN: The first thing it needs is a solid technology.

Something that’s actually going to be worth using in the future.

So many of these coins claim to have a true technological use, but it’s pretty clear right away when there’s nothing there.

You want someone with a high-level tech team, a clear purpose for the coin and an achievable plan to implement it.

The second thing is strong adoption.

CHRIS: What does that entail?

JUAN: That means the use for the crypto – no matter how cool it sounds – needs to actually have people using it in practice.

If more and more firms adopt this particular blockchain technology, then that underpins the demand for the coin on the open market.

You want to see strong adoption, which creates anti-fragility for the coin.

CHRIS: What else do you like to see in a promising altcoin?

JUAN: Beyond adoption, you want to see a passionate following in the crypto market.

You want to read message boards and see people excited about the coin.

If I tweet something negative about the coin and I get a lot of nasty blowbacks, that’s often a good sign.

CHRIS (laughs): How so?

JUAN: It means people feel an almost emotional attachment to that coin.

That means the coin will still have buyers underpinning the price when there are dips.

You need a passionate community to get an unknown crypto off the ground.

Unfortunately, it’s a bit like a popularity contest.

CHRIS: But isn’t that every market?

JUAN: It is, Chris.

Crypto is no different from the stock market, the Forex market and beyond.

CHRIS: So, in this current crypto bull market, with the Bitcoin halving looming as a potential rocket fuel for crypto prices …

Which altcoins should we be focused on?

JUAN: I’ve identified ONE virtually unknown coin I think you should buy before all of the others.

This is the coin I’m most excited about right now. I think it has the same potential as Cardano – when I first found it.

I’ll share all of the details about this unique project with you in my special briefing called, “The ONLY Altcoin to Own Right Now.”

Using our Weiss Crypto Ratings – and some other detailed analysis I do with every crypto I recommend – I’ve identified the most promising coin for this bull market.

I think this coin could bring back big returns in the short term …

But I also think it’s one to hold for the long run as well.

This is the kind of coin that could make you life-changing gains.

CHRIS: How can folks get a copy of this report?

JUAN: All you have to do is take a risk-free subscription to my monthly newsletter, Weiss Crypto Investor.

Weiss Crypto Investor uses my proprietary bull market timing model – and the Weiss Crypto Ratings – to determine which coins you should buy – and when you should get in and out of those coins.

So, you can have the opportunity to buy or sell ahead of the crowd.

You’ll always get my latest updates before anyone in the public hears my prediction.

I won’t say it on TV, a podcast, in an interview with you Chris or anywhere else – before I’ve told my Weiss Crypto Investor subscribers.

CHRIS: With the speed the crypto market moves, that's very valuable.

JUAN: Every month, I’ll give you the newest information from my proprietary algorithm. I’ll show you exactly where you are in the cycle.

And I’ll recommend what I think you should buy and sell with the investment money you allocate to crypto.

The idea – simple as it is – is to use the timing model to tell us the best time to enter and exit our positions.

Is it always possible to time things exactly?

Of course not, there is no perfect system for investing.

However, our overall track record in Weiss Crypto Investor is remarkable.

We’ve recommended 30 separate crypto trades over the last five years.

The average gain was 328%.

And that includes the losers.

Some of the winners were even more extraordinary.

Like, 1,135% on THORChain …

And 2,925% on Cardano.

Anyone following my signals could’ve doubled their money or better three different times on Bitcoin.

They could’ve booked gains of 673% ... 1,148% ... and 826% on Ethereum.

Booking these kinds of big gains requires precise timing.

So don’t worry, I won’t leave you sitting on the sidelines while the big moves are happening.

I will alert you at any time during the month, as soon as possible, whenever something changes with our recommendations or the crypto market as a whole.

Plus, you’ll get full subscriber-level access to our Weiss Crypto Ratings.

Remember, we’ve issued 131Buy ratings, since we invented the ratings system in 2017.

The average gain was 342%.

Some of the winners were extraordinary …

Viacoin returned 5,508%.

Neo is up 4,166% since we rated it a “Buy.”

And Ripple is up 3,989%.

CHRIS: Having access to the Crypto Ratings …

While also staying up to date on where we are in your bull market cycle …

That could be a very valuable combination, Juan.

Folks, here’s everything you get today, when you subscribe to Weiss Crypto Investor:

- 12 Monthly Issues. On the fourth Friday of every month, you’ll get a new issue full of Juan’s latest research on the crypto market, along with a fresh recommendation on where you should be investing your money.

- ASAP Alerts and Updates. Any time the market swings or something changes with one of Juan’s recommendations, you’ll be the first to know. We’ll send timely alerts to keep you ahead of the rest of the crypto market.

- Free subscription to Weiss Crypto Daily. Keep up with the everyday movements of the crypto market with our expert crypto analysis. All of our analysts contribute to bring you the latest news, gossip and investment advice in the world of crypto.

- Full Access to our Weiss Crypto Ratings. Since we created these ratings in 2017, we rated 131 cryptos a “Buy” and the average gain was 321% -- including the losers. Our Ratings are fed the latest data instantly and are maintained by some of the top data engineers in the world. You’ll get bonus access to features not available to the public.

- Plus, Juan’s special report, The Only Alt-coin to Own Right Now. Juan has picked out one alt-coin he predicts could really take off as Wall Street gets control of the crypto market. This could be the next Cardano. And you can get it at a great price right now. Find out all the details in this report.

JUAN: On top of that Chris, I’ll give you an extra bonus report.

It’s called, The Ultimate Bitcoin Timing Guide: How to Pick the Big Bottoms and Big Tops with Confidence.

I’ll show you how to spot the different stages of a crypto bull market – and how to use them for a chance to avoid losses and book maximum gains.

Weiss Crypto Investor is not a trading service. We don’t jump in and out of recommendations. But we do use the timing model to sell before the top and buy at the bottom.

CHRIS: Also, I want to be clear with everyone at home. We mentioned this was a “risk-free” subscription to Weiss Crypto Investor.

Here’s what we mean:

Your Weiss Crypto Investor subscription lasts for one year.

If you’re not satisfied with the service, you can cancel, and we’ll give you a full refund – at any time during your first 12 months.

We want you to feel comfortable with our research and recommendations.

JUAN: I think, once you’ve had a chance to dig into your bonus reports and see the potential value in my recommendations, you’ll want to stay with us for the long haul.

That’s why we’re confident in giving such a generous refund policy.

CHRIS: So, how much will a year of Weiss Crypto Investor cost, Juan?

JUAN: Our publishers value the special reports I mentioned at nearly $1,000 or more.

And we could probably get away with selling these for that much.

But our stated goal is to give regular folks a chance at life-changing crypto gains.

And charging thousands for this service would defeat that purpose.

So, we decided to make the price ridiculously low.

CHRIS: How low, Juan?

JUAN: Lower than the price for an entrée at a halfway decent restaurant.

Less than a tank of gas for your car …

Our normal retail price is $129 …

But today … it’s just $49.

CHRIS: For a full year?

JUAN: That’s right, Chris.

CHRIS: Some quick math tells me that’s like 13 cents a day.

For a chance to make life-changing gains.

Folks, if this sounds like a good deal to you, then please click the button below.

You’ll get a chance to review the details of this offer before you sign up.

Juan … anything else you want to say before we go?

JUAN: Yes.

We’ve laid out all of the facts today.

The Crypto Convergence is here.

I predict this will be one of the most unique bull markets ever – not just in crypto history, but in the history of markets.

All three of these events coming together at once could create an explosive market …

And I’m here to guide you through it …

Not just to potentially help you make huge gains during the bull market.

But to also use my crypto timing model to monitor any changes in direction.

So, you’ll know when the party’s over … And you can get out ahead.

This is going to be a very exciting year.

And I’d love to help make it one of your best ever as an investor.

Join me at Weiss Crypto Investor today.

And let’s go for profits together.

Click the button below to take advantage of our special discount, right now.